Tesla is preparing to launch its robo taxi in June, leveraging its unique autonomy and data advantages to navigate challenges such as new tariffs and production shifts, while positioning itself for significant growth amid declining competitor viability

Questions to inspire discussion

Tesla's Robo Taxi Service

🚕 Q: When and where is Tesla launching its robo taxi service?

A: Tesla's robo taxi service is set to launch in Austin, Texas in June 2025, with plans for a nationwide rollout in the US later that year.

🏎️ Q: What vehicles will be eligible for Tesla's robo taxi service?

A: The service will be available on all vehicles equipped with Full Self-Driving (FSD) capability, including existing Model 3 and Model Y, not just the upcoming Cybertruck.

💰 Q: How will Tesla's robo taxi network economics work?

A: The economics will be based on cost per mile, factoring in low capital costs of Tesla EVs and low power consumption of their onboard autonomy systems.

📊 Q: What competitive advantage does Tesla have in the robo taxi market?

A: Tesla's existing fleet of billions of miles of deployed vehicles and hundreds of thousands of users provide a massive data advantage for improving and assessing the service.

Tariffs and Supply Chain

🏭 Q: What is Tesla's supply chain strategy?

A: Tesla aims to build cars where sold for environmental reasons, which is considered best practice in network design but extremely difficult to implement.

📈 Q: How could new tariffs impact the auto industry?

A: 25% tariffs on imported cars and auto parts could significantly impact legacy automakers like Ford, GM, and Stellantis, while benefiting Tesla, which sources 100% of its cars in the US.

🌐 Q: How is Tesla positioned to handle potential tariffs?

A: Tesla's global manufacturing strategy of building factories on every continent and sourcing 95% of parts locally has positioned them well to weather potential tariff impacts.

🔧 Q: What components does Tesla manufacture in its US factories?

A: Tesla's US factories handle high-value components like motors, inverters, and battery packs, while lower-value parts are imported.

Financial Impacts and Projections

📉 Q: What are the expectations for Tesla's Q1 2025 results?

A: Analysts model 350-370K deliveries, with significant discounting on old Model Y inventory, averaging $2K per vehicle, and some as high as $88K.

💼 Q: How will the Model Y retooling affect Tesla's Q1 2025 earnings?

A: The Model Y changeover at four plants is expected to impact margins and productivity, with analysts modeling 30 cents adjusted EPS vs. 45-46 cent consensus.

🔮 Q: What factors will be key for investor sentiment in Tesla's Q1 2025 earnings call?

A: The order inflow rate and guidance aligned with a growing yearly outlook and executing on Model Y ramp will be crucial for stock recovery.

Full Self-Driving (FSD) and Future Prospects

🚗 Q: How are FSD take rates expected to change in 2025?

A: FSD take rates are expected to increase significantly as FSD expands to China and potentially Europe, with v13 software providing a compelling experience on Hardware 4 vehicles.

💵 Q: What is the potential impact of increased FSD take rates on Tesla's financials?

A: With an $8K price and few thousand dollars in gross margin per vehicle, even modest increases in FSD take rates would have a large impact on Tesla's overall economics.

Competitive Landscape

🏆 Q: How might tariffs affect Tesla's competitive position?

A: Tariffs could give Tesla a competitive advantage over legacy automakers struggling to adapt quickly, potentially leading to a significant decline in their profits.

🌍 Q: How might tariffs impact the overall US vehicle market?

A: Tariffs on auto parts could shrink the overall US vehicle market, but present an opportunity for Tesla to capture market share if competitors struggle to adjust.

Manufacturing and Localization

🏭 Q: Why is localization important for Tesla's supply chain?

A: Localization is critical to mitigate potential 25% tariffs on parts and finished goods, which would significantly impact margins and profitability.

⏳ Q: How quickly can Tesla implement supply chain localization?

A: While Tesla can drive localization, it will take time and not be overnight to fully implement changes in response to potential tariffs.

Executive Compensation

💼 Q: What could happen if Tesla loses the appeal on Elon Musk's pay?

A: If Tesla loses the appeal, the $2.3 billion would be recited, benefiting shareholders, but Tesla may need to find alternative ways to remunerate Musk, which could be costly.

Future Outlook

📈 Q: What impact could the robo taxi service have on Tesla's financials?

A: Tesla's robo taxi service is expected to have a dramatic impact on the company's margins and profitability once it reaches peak performance.

🌐 Q: How does Tesla's vertical integration affect its position in the market?

A: Tesla's vertical integration and local sourcing of high-value components give them a competitive advantage, especially in the face of potential tariffs.

🔬 Q: What role does Tesla's AI technology play in its future prospects?

A: Tesla's AI4 computer assembly and ongoing development of FSD software are key factors in maintaining its technological edge and potential for improved margins.

Key Insights

Autonomous Driving and Robo Taxi Service

🚗 Tesla's robo taxi service launching in Austin, Texas in June 2025, marking a major milestone for the company's autonomous driving ambitions.

🔬 Tesla's vision-only approach to autonomy, combined with lower EV costs and drivetrain efficiency, expected to result in the lowest cost per mile for robo taxis.

📊 Analysts anticipate significant price target increases and earnings upgrades for Tesla following the robo taxi launch, based on concrete unit economics from Austin's performance.

💰 Tesla's robo taxi service projected to have a dramatic impact on margins and profitability, with a potential cost per mile target of 20 cents at peak performance.

🌐 Tesla's existing fleet of Model 3s and Model Ys, along with the upcoming Cyber Cab, will enable a potential nationwide rollout in the US by 2025.

Tariffs and Manufacturing

🏭 25% tariffs on imported cars and parts, effective April 3rd and May 3rd 2025, will significantly impact legacy automakers but not Tesla, which makes 100% of its cars in the US.

🚙 Legacy automakers face massive challenges adapting to tariffs, with 40-50% of their cars made outside the US, compared to Tesla's 100% US-made vehicles.

🔧 Tariffs will force automakers to restructure, pare down models, and redesign products, with significant supply chain and gross margin impacts.

🌍 Tesla's long-term strategy to build factories on every continent with 95% local parts sourcing protects them from current tariff impacts.

Tesla's Competitive Advantage

💻 Tesla's unique data advantage in autonomous driving and full self-driving (FSD) program will clearly separate it from competitors like Uber and Lyft.

🧠 Tesla's AI4 computer assembly could potentially be moved to the US, avoiding 25% tariffs on auto parts.

🚀 Tesla's US factories perform high-value assembly of motors, inverters, and battery packs, contributing to their tariff-resistant position.

Market Dynamics and Competition

📉 25% auto parts tariffs could make some GM, Ford, and Stellantis vehicles economically unviable, shrinking the 16M US vehicle market.

🇨🇳 China's EV manufacturers like BYD may face medium to long-term challenges if other markets follow suit with similar tariff policies.

🚗 European and Asian automakers that set up final assembly outside the US may struggle with increased tariffs on imported parts.

Tesla's Financial Outlook

📊 Tesla's Q1 2025 results expected to show 100,000+ less Model Y deliveries due to factory shutdowns for retooling, impacting margins.

💹 FSD take rates likely to increase globally in 2025, driven by FSD v13's quality on Hardware 4 vehicles, potentially reaching 10% subscribers and 2% outright buyers.

📈 Tesla's Q1 2025 earnings call expected to show 340-380K deliveries, with FSD revenue recognition from China, but lower EPS around $0.30 vs. $0.45 consensus.

Industry Implications

🚛 Tesla's FSD expansion into China and potential Europe release in 2025 could significantly impact the truck industry, enabling 24/7 operations without drivers.

💼 Non-tariff barriers like VAT, import, and knockdown duties in countries like Brazil make US-built cars 38% more expensive, highlighting the need for local manufacturing.

Competitor Challenges

🔍 BYD's financial health questioned due to 26% of 2024 net income ($1.4B) from government subsidies and 250+ days payable to suppliers.

🚗 Ford faces significant challenges, while Honda and Toyota are relatively better positioned with full models but still need some sourcing adjustments.

Future Outlook

🔮 Tesla's robo taxi service launch in Austin is seen as a catalyst for the company's stock, with the potential to reignite investor excitement and drive significant price increases.

🌐 March 3 component tariffs could significantly impact Tesla's localization efforts and margins, as most vehicles cannot absorb a 25% hit on both finished goods and parts levels.

#Tesla

XMentions: @Tesla @HabitatsDigital @Cyberbulls @TeslaBoomerMama @theJeffLutz

Clips

-

00:00 🚗 Tesla's robo taxi launches in June amid a 25% tariff on foreign cars, with exciting developments expected at the Austin shareholder meeting.

- Tesla is set to launch its robo taxi in June, while President Trump has imposed a 25% tariff on foreign cars, potentially impacting various car manufacturers and Tesla itself.

- Tesla's robotaxi service is set to launch in Austin this June, with strong confidence from the team despite previous doubts.

- Executives express excitement over the upcoming rollout of Tesla initiatives in Austin, Texas, with expectations for significant developments in the next three months, including a potential shareholder meeting in June.

- The upcoming shareholder meeting at Giga Austin will be memorable, especially with the possibility of arriving in autonomous vehicles.

- A chance encounter with a Cybertruck driver allowed the speaker to bypass a long line and reach the Tesla Giga Factory in Austin.

- A significant moment occurred when they bypassed long lines to install an important sign in the gigafactory after a crucial vote passed, creating a sense of euphoria.

-

06:37 🚗 Tesla is set to unveil its robo taxi plan in June, which could boost analyst confidence and price targets despite existing skepticism, as the company leverages its unique autonomy approach and data advantages for significant growth.

- Tesla is expected to reveal its robo taxi plan in June, which may not significantly alter existing forecasts for most analysts.

- Despite skepticism surrounding Tesla's robotaxi network, successful implementation could lead to significant price target increases and earnings upgrades as analysts gain confidence in its economic viability.

- Tesla's unique approach to autonomy, cost efficiency, and drivetrain performance positions it to maintain the lowest cost per mile and dominate market share despite competition.

- Tesla's recent event in Texas signals strong confidence in the upcoming launch of its robotaxi by June, despite the absence of a specific permit.

- Tesla is poised for significant growth due to its existing capital and hardware advantages, with upcoming releases expected to enhance its service and software capabilities.

- Tesla is confident in its expanding data set from its deployed fleet, which will lead to significant improvements and a transformative economic model for its Robo taxi experience in the near future.

-

15:34 🚗 Tesla is making strides in autonomous vehicles and infrastructure while navigating potential financial and corporate challenges related to Elon Musk's compensation and Delaware's corporate status.

- Tesla is advancing its plans for autonomous vehicles with existing models while developing the purpose-built Cyber cab, signaling significant progress in the industry.

- Tesla is developing prototypes for a comprehensive ecosystem that includes wireless chargers and automated cleaning services for their vehicles.

- Tesla aims to design an efficient infrastructure to achieve a target cost of 20 cents per mile, which will require significant time and effort beyond just the vehicles themselves.

- If Delaware upholds the decision on Elon's pay, Tesla may need to adjust future earnings due to tax implications, but the speaker believes they will win the appeal.

- Delaware is at risk of losing its corporate dominance due to potential federal incorporation laws and competition from states like Texas and Nevada, prompting a strong push to win an ongoing appeal.

- Tesla may explore various options for compensating Elon Musk, including utilizing previous shareholder votes or creating new share classes, but uncertainties remain regarding the best approach.

-

21:31 🚗 Tesla is bracing for a new 25% tariff on foreign cars, which could reshape the auto industry and necessitate strategic adjustments amid varying impacts on competitors.

- Tesla is preparing for potential impacts from a new 25% tariff on foreign-made cars, which could affect parts prices and competition, while awaiting legal developments and updates on appeals.

- A new permanent tariff on imported cars and auto parts, effective April 2nd and May 3rd respectively, will significantly impact the auto industry, particularly legacy automakers, potentially leading to a major decline in profits.

- Automakers face varying impacts from supply chain issues, with Tesla and Rivian in a relatively stable position, Ford experiencing moderate effects, and GM, Volkswagen, and others facing severe challenges.

- Automakers face significant economic challenges in shifting production from Mexico to the U.S. due to higher labor costs, necessitating a reevaluation of their model sizes and strategies.

- The company must assess the economic impact of upcoming changes, prepare a comprehensive plan for the board, and publicly communicate the implications for the business before the earnings report.

- The business strategy involves restructuring and redesigning products for future operations.

-

30:35 🚗 Tesla's production strategy shifts to Mexico for cost efficiency amid upcoming USMCA renegotiations and potential tariff challenges, impacting their supply chain and job creation.

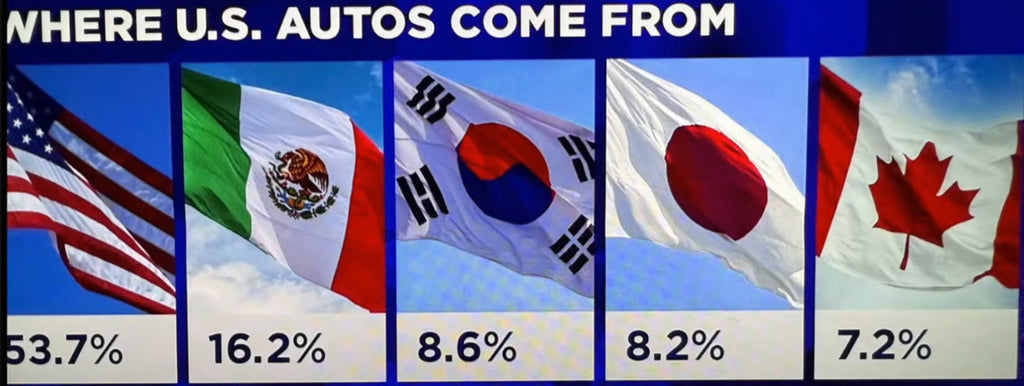

- The U.S. auto industry is misleadingly represented by a 54% insourcing figure, as the actual value added through labor and capital efficiency is significantly lower.

- Tesla's production strategy involves moving high labor content manufacturing to Mexico for lower labor costs, while complying with USMCA wage requirements.

- The upcoming renegotiation of the USMCA and the scheduled import changes are expected to create significant challenges for the US auto industry, particularly between April 3rd and May 3rd, as automakers struggle to adapt.

- Tesla faces potential challenges from new tariff barriers on auto parts, which could impact their supply chain and production costs, particularly as they analyze the implications beyond April 3rd.

- Tesla conducts most of its assembly and production in the US, but faces challenges with components like the AI4 computer, which may be sourced from Mexico and Taiwan, potentially impacting tariffs and job creation.

- Building the AI4 computer in the US is feasible despite higher costs due to automated processes, but uncertainties remain regarding the overall cost structure.

-

39:08 🚗 Tesla is poised to thrive amid declining competitor viability and new tariffs, thanks to its local assembly and supply chain strategies, while other automakers face significant challenges.

- Tesla is well-positioned to capitalize on the declining viability of competitors' vehicles due to its local assembly and supply chain strategies, which were established years ago.

- Tesla's strategy focuses on building cars locally in various markets, unlike competitors who rely on cheap labor, but upcoming tariffs may significantly reduce the US vehicle market size.

- Tesla's market position may strengthen despite a potential overall market shrink as it expands into new vehicle segments.

- New tariffs on auto parts and finished goods signal a permanent shift in supply chain investments, requiring automakers to plan for significant changes in production locations.

- The new tariffs on electric vehicles and auto parts will significantly impact global supply chains, particularly affecting China's automotive industry and its suppliers in Mexico.

- Tesla and Rivian are in a relatively good position despite some impacts from sourcing, while Ford faces challenges, and other automakers like GM, VW, and several Asian companies are in tougher situations.

-

46:57 🚗 Tesla's production and delivery are set to decline in Q1 due to factory retooling and Model Y changes, compounded by tariffs and global market challenges.

- Manufacturing jobs in the US are crucial for creating a professional ladder and countering high tariffs and non-tariff barriers that inflate costs for exporting vehicles.

- China's strategic development of international markets may mitigate short-term impacts from tariffs, but could face long-term challenges as other regions prioritize job protection.

- Manufacturers face protectionist barriers in Brazil, impacting U.S. industry competitiveness, and while tariffs are a concern, a balanced approach with scheduled implementation is necessary to support local factory development.

- Upcoming tariffs could significantly impact Tesla and the US auto industry, necessitating increased localization of parts to mitigate economic effects.

- Tesla is expected to report significantly lower Q1 production and delivery numbers due to factory shutdowns for retooling, impacting earnings more than anticipated.

- Tesla faces significant production and margin challenges in Q1 due to the Model Y changeover, resulting in lower vehicle deliveries, increased downtime, and substantial discounting on older inventory, though some revenue from FSD in China may provide slight offsets.

-

58:36 🚗 Tesla's earnings may rise from FSD sales in China despite weak delivery numbers and production issues, while competition faces financial pressures, and significant stock growth is anticipated by mid-2026.

- Analysts expect a modest boost in Tesla's earnings from FSD sales in China, despite low upgrade percentages and the absence of a subscription model.

- Tesla is expected to report weak delivery numbers due to production issues, particularly with the Model Y, which may mislead public perception despite being anticipated.

- China's auto industry, particularly BYD and NIO, is facing significant financial pressures and declining operating leverage despite reported growth, raising concerns about their long-term health and competitiveness against Tesla.

- BYD's net income is significantly bolstered by government subsidies, raising concerns about supply chain practices in China, while Tesla's future looks promising with potential expansions in FSD technology.

- Tesla's potential increase in Full Self-Driving (FSD) take rates could significantly enhance its overall economics, particularly in the trucking industry, where autonomous vehicles could operate continuously without drivers.

- Tesla's stock growth is expected to mirror Nvidia's trajectory, with significant earnings growth anticipated by mid-2026, while the live stream schedule is changing to Fridays for better promotion.

-------------------------------------

Duration: 1:10:8

Publication Date: 2025-03-27T18:08:39Z

WatchUrl: https://www.youtube.com/watch?v=STUxDnzOk0E

-------------------------------------